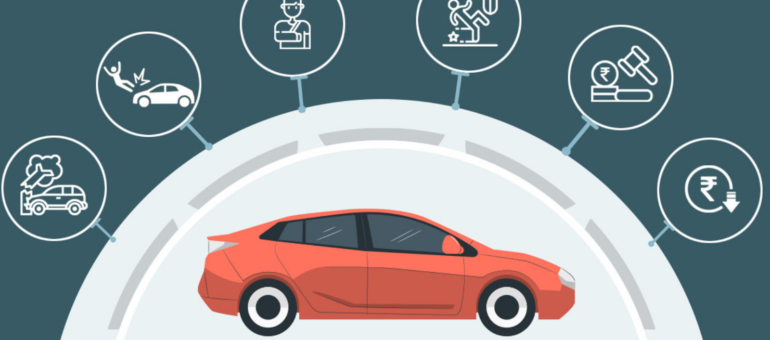

Motor Third Party Insurance Decoded

Motor Third Party Insurance is the most commonly heard general insurance term in India. Millions of vehicles are covered each year under a Third Party policy. Yet, not many people are aware of the meaning and scope of the term third party.

The most commonly understood meaning is that while the insurer and the insured are the first two parties, being parties to the contract, everyone else is a third party. While this may sound logical, not every third party as per this definition is covered. So, it would be better to differentiate between covered third parties and third parties not covered by the Policy required by the Act. The current law in force to regulate ownership and use of vehicles in India is the Motor Vehicles Act, 1988. This Act has also been amended several times, the last of these amendments being enacted in 2019. Those provisions of the 2019 amendment which pertain to ‘third party insurance’ have come into effect on 1st of April 2022.

Table of Contents

Who are the covered third parties in Motor Third Party Insurance?

1. Persons required to be covered by the policy mentioned in the Act –

(a) All persons and their property outside the vehicle, whether public or private, passenger-carrying or goods carrying.

(b) Passengers of a public service vehicle – bus, taxi, etc.

(c) Owner of goods or their representatives being carried in a goods carrying vehicle.

2. Persons not covered by the policy required by the Motor Vehicles Act, 1988 –

(a) Owner of the vehicle.

(b) Persons driving the vehicle at the time of the accident, except the driver of the transport vehicle.

3. Persons not required to be covered by the policy –

(a) Passengers of private cars and pillion riders of two-wheelers.

(b) Passengers being carried in a vehicle not meant to carry such passengers, like in case of goods carrying vehicles (except otherwise permitted as in case of the owner of goods), or a tractor.

In case of some of the persons falling in 3(a) & (b), who are not required to be covered under the Policy as required by the Act, the owner of the vehicle will still be liable for any injury, death or loss of property to such persons. Persons under 3(a), though not covered under the Motor Third Part Policy (also called the ‘Act Only’ Policy are covered in the same manner as other third parties in case of a Package (also known as Comprehensive) Policy.

There is the provision under the India Motor Tariff to have certain persons not normally covered, by paying some additional premium, on payment of which additional contracts named IMT – xx (xx represents numbers assigned to these contracts) are affixed to the main Policy.

Provision related to coverage of drivers – Only drivers of transport vehicles is covered. A transport vehicle means a public service vehicle, a goods carriage, an educational institution bus or a private service vehicle. Persons driving private cars and 2-Wheelers are not covered, whether these persons are paid drivers or family members/friends of the owners.

The amended Act says that ‘third party’ includes the driver and any other co-worker on a transport vehicle. Hence, cleaners/khalasis, ticket examiners, etc are covered without charging any additional premium.

Sections under which claims can be made in Motor Third Party Insurance –

Sec 164 – It is a provision under which a claim may be made without proving the fault of the respondent. The amounts of compensation are fixed – Rs. 5,00,000/- in case of death and Rs. 2,50,000/- in case of grievous hurt. The definition of grievous hurt is the same as that given under Sec 320 of the Indian Penal code, 1860. This provision existed as Sec 163-A before the amendment of 2019, but with a different compensation structure.

Sec 166 – Fault of the respondent must be proved in this case. For property damage, the amendment of 2019 has removed limits on the maximum amount payable. For injury, it is the amount of loss that is proved by the claimant. For death, the Act says that ‘just compensation’ is payable. Just compensation is an evolving concept, and the Supreme Court of India has been modifying it from time to time. For a long time, the formula adopted in 2009 in Sarla Verma v. Delhi Transport Corporation was followed, which was modified in 2017 in Pranay Sethi v. National Insurance Company.

Before the amendment of 2019, there was one more provision to claim under Sec 140, which has been removed after the amendment.

In case the vehicle causing the accident could not be identified, there is a provision for compensation under Sec 161. These are called ‘hit and run cases. The compensation is Rs. 2,00,000/- in case of death and Rs. 50,000/- in case of grievous hurt. The Scheme in this regard is made by the Central Government and administered by the State Government. This claim is not brought against any insurance company.

Who can make a third-party claim?

- In case of property damage, the owner of the property.

- In case of injury, the injured person.

- In case of death, any legal representative may claim, whether such person was dependent on the deceased or not. Any claim filed is on behalf of all eligible persons.

How much is the compensation in a third-party claim?

• In case of property damage, the amount of loss.

• In case of injury, the amount of loss which is the total of the loss of earning for the period of injury, the loss of future earning capacity, medical expenses on treatment, any other cost incurred as a result of the injury, like special diet, cost of travel for treatment, for nursing support at home, etc.

• In case of death the Motor Vehicles Act only says just compensation. it is an ever-evolving concept. The Supreme Court has devised a formula for the calculation of compensation in death cases. The age of the deceased, his / her income, and the number of persons who were dependent on the deceased have been considered factors for the calculation of the compensation amount. There are a few other minor components too.

ANALYSIS OF DOCTRINE OF RES GESTAE under Indian Evidence Act 1872

FOLLOW US