BENAMI TRANSACTIONS | Benami Property Transactions Act -1988

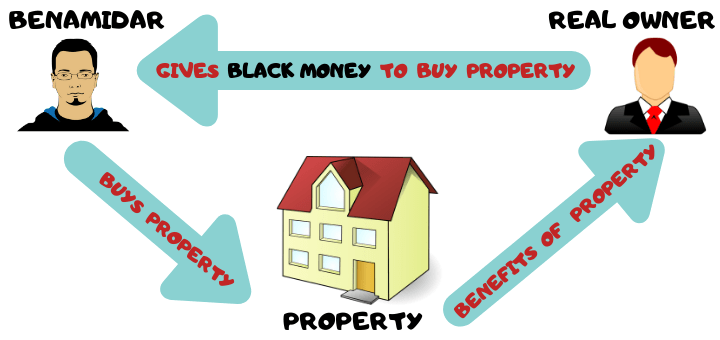

Meaning: The word is “Benami” means without name. A Benami transaction or property is one in which the name of another person or a fake person is used instead of the person’s own name. The Benami Transactions (Prohibition) Act of 1988 established the first law governing Benami transactions. There were just eight sections to this Act. The Benami Transactions (Prohibition) Amendment Act, 2016, which included 72 sections, later changed the law.

The basic purpose for entering into Benami transactions is to achieve undesirable purposes such as utilizing black money, evading the payments of taxes, and also avoiding payments to creditors. Therefore in order to deal with this issue of Benami transactions, the parliament initiated to pass a central act, i.e. The Benami Transactions (Prohibition) Act, 1988, with a view to prohibiting all Benami transactions being entered into by the people for promoting one or the other illicit purposes.

Table of Contents

Purpose of this Act:

In this property is held by one person and consideration is paid by the other person. After determining whether the property is Benami or not, the authorities may issue an order canceling or confirming the attachment. Such an order must be issued within one year of the month in which the reference under this Act was received.

Difference between ostensible owner and Benami Transaction:

- Ostensible Owners: apparent owners and Benami transactions: without a name

- Benami Transactions: The real ownership of a property is held by someone who pays the consideration, while the ostensible ownership: is held by the benamidar, who just lends his name to the title papers.

Landmark cases in Benami Transactions:

Meenakshi Mills, Madurai v. The Commission of Income Tax, Madras- This is the case wherein, the decision of the case of Thakur Bhim Singh (Dead) by Lrs and Anr. v. ThakurKan Singh[1], was reiterated.

- Thakur Bhim Singh (Dead) by Lrs and Anr. v. Thakur Kan Singh[2]- The apex court in the instant case has laid down the principles governing the determination of a question of whether the transaction is a Benami transaction or not. Following mentioned are bullets that need to be kept in mind:-

- The burden of showing that a particular transaction is a Benami transaction lies on a person who asserts that it is such a transaction.

- If it is shown that the purchase money concerning a particular property came from the person other than the one in whose favor a particular property has been transferred, then it would be presumed that the purchase of the property has been done in favor of the person who has supplied the purchase money.

- The true character of the transaction needs to be brought out from the intention of the person who has contributed the purchase money.

- The question with regard to the intention of the person who has contributed the purchase money needs to be considered on the basis of the surrounding circumstances, the relationship of the parties, their motives, and the subsequent conduct of the parties.

Amendment of Act in 2016:

- The number of sections increased from 9 to 72

- The name of the un-amended Benami Act was changed to “The prohibition of Benami Property Transactions Act, 1988”

- Amended the already amended sections from Section 1 to Section 9.

- Imprisonment and Fine:

- For guilty of the offense of a Benami transaction: Fine- Up to 25% of the FMV and Imprisonment- Minimum 1 up to 7 years.

- For Providing False Information: Fine- Up to 100% of the FMV and Imprisonment – Minimum 6 years up to 5 years.

The new Benami Transactions (Prohibition) Act 2016 expands the scope of the law. The new act, with its broader scope, will be a big assistance in dealing with this societal misconception, i.e. Benami properties. Many similar disputes involving Benami properties could not be resolved due to the prior Act’s narrow and confusing scope. However, because of the expanded and more explicit scope of the legislation, such incidents may now be easily proven in a court of law.

The general understanding of “Benami property” has shifted dramatically, and it now encompasses all transactions and arrangements other than those involving immovable property.

Conclusion:

Benami Transactions are a threat to the normal functionary especially in the property sector, as the people utilize this method of purchasing properties as a fixed formula to adjust their black money in order to avoid the payment of heavy taxes that would otherwise be levied upon the taxpayer. Such transactions need to be eradicated completely by the strict and conscious efforts of the government. The government has in fact, to a greater extent succeeded in implementing such policies by virtue of which, it believes to eradicate the issue of Benami transactions. Not only the government but also the people should come forward and make certain contributions in identifying the people involved in Benami transactions so that the government is able to take necessary steps in the future and hence frame the future course of action.

[1](1980) 3 SCC 72.

[2](1980) 3 SCC 72

Basic Concept of Comparative Advertising

Like and Follow us on :

Facebook Twitter Instagram LinkedIn